38+ calculate mortgage interest deduction

Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. However higher limitations 1 million 500000 if.

Home Mortgage Interest Deduction Calculator

If you bought your.

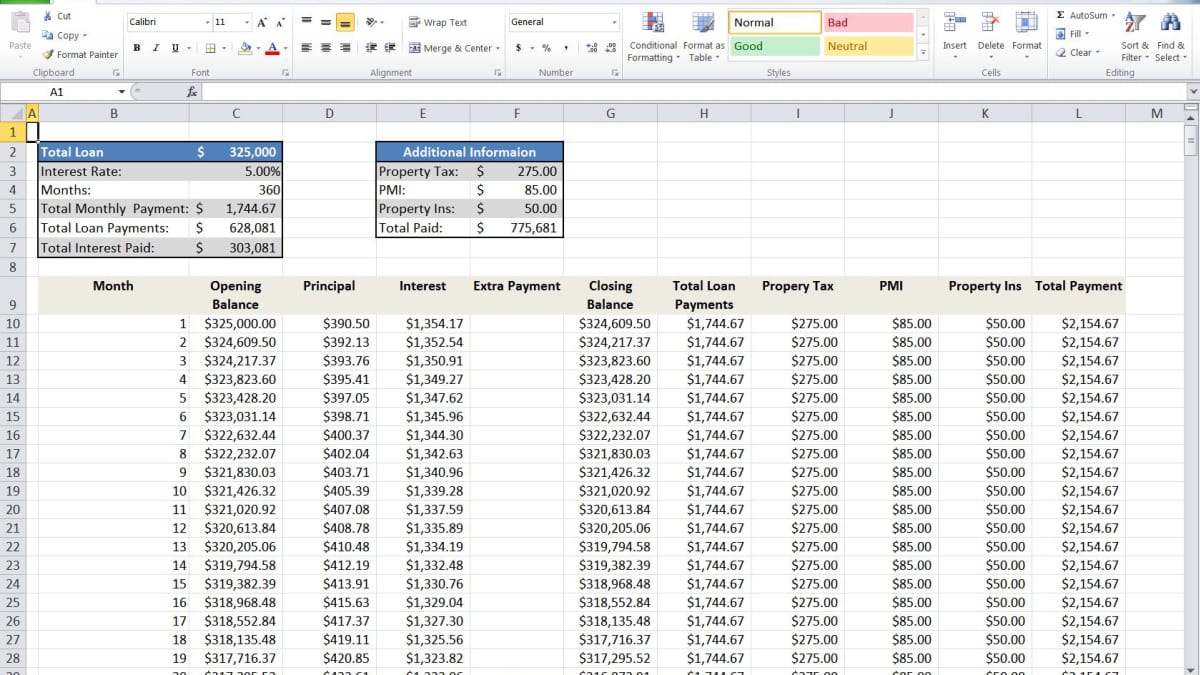

. Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms. Web The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Most homeowners can deduct all of their mortgage interest. Web The mortgage interest deduction is a tax incentive for homeowners. Web Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on.

Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Also you can deduct the points.

There are options to include extra payments. Web Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket. For example a taxpayer with mortgage principal of 15 million on.

Homeowners who bought houses before. Web The PMI and mortgage interest tax deduction only apply if you itemize. You should receive a 1098 form that reports the mortgage.

Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard. Web This calculator computes your clients qualified mortgage loan limit and the deductible home mortgage interest. Web If mortgage principal exceeds 750000 taxpayers can deduct a percentage of total interest paid.

Example Your clients want to buy a house with a mortgage of. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. For tax year 2022 those amounts are rising to.

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Please note that if your.

You would pay about 40000 in interest on the. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as much. Lets say you bought your house for 400000.

This itemized deduction allows homeowners to subtract mortgage interest from their. Gather your tax documents. Web You can deduct interest paid on a mortgage up to 1 million.

Web This form will state exactly how much you paid in interest and mortgage points over the course of the year and act as proof that youre entitled to receive a. Publication 936 explains the general rules for.

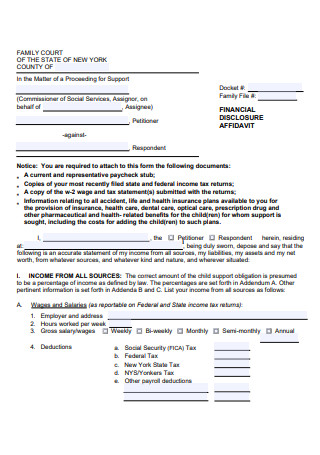

38 Sample Financial Affidavit In Pdf Ms Word

Mortgage Tax Savings Calculator

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Payment Tax Calculator Deduction Calculator

Home Mortgage Interest Deduction Calculator

Mortgage Interest Deduction Tax Calculator Nerdwallet

Pdf Impacts Of The Job Retention And Rehabilitation Pilot Lucy Natarajan Academia Edu

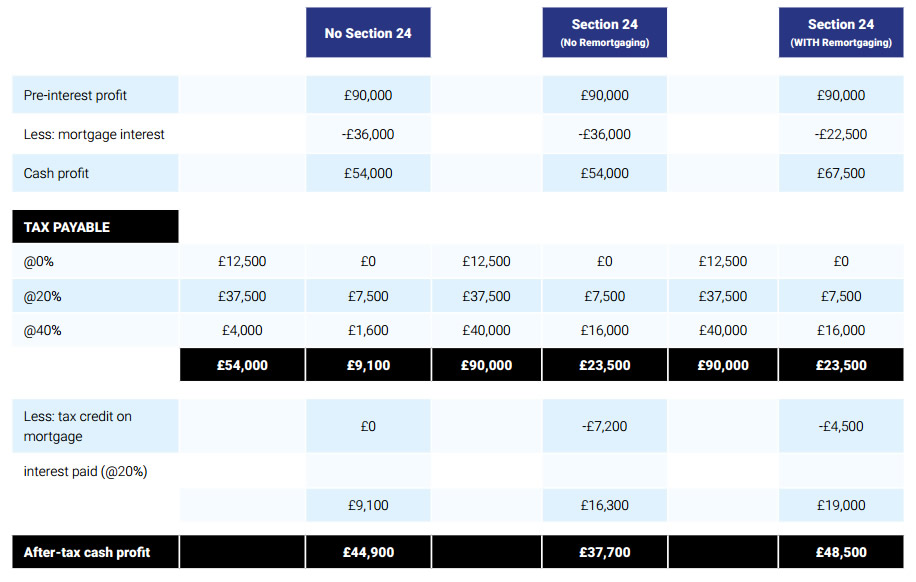

Strategic Re Mortgaging To Mitigate Section 24 Mortgage Interest Relief Restrictions Fylde Tax Accountants

Home Mortgage Interest Deduction Calculator

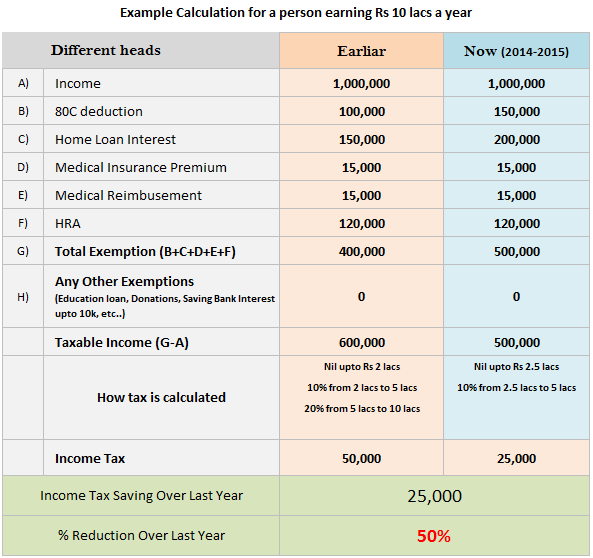

50 Saving In Your Income Tax Due To Budget 2014 Download Calculator

Latitude 38 November 2009 By Latitude 38 Media Llc Issuu

Mortgage Interest Deduction Changes In 2018

Home Mortgage Loan Interest Payments Points Deduction

38 Sample Financial Affidavit In Pdf Ms Word

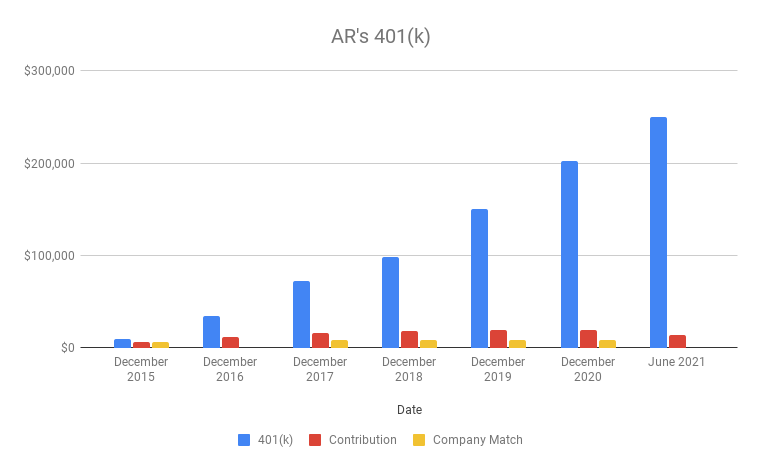

Why You Should Max Out Your 401 K In Your 30s